maryland student loan tax credit 2021

The Student Loan Debt Relief Tax Credit Program deadline of September 15 is just under two weeks away and Comptroller Peter Franchot and Maryland College Officials are urging. File 2021 Maryland State Income Taxes.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

It was established in 2000 and is an active.

. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland. It was established in 2000 and is. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Ad Get a Personal Plan to Fit Your Budget. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by.

You Decide How When You Want to Pay. It was founded in 2000 and is a. About the Company Student Loan Debt Relief Tax Credit 2021 Maryland.

If the credit is more than the taxes you would otherwise owe you will receive a. CuraDebt is a company that provides debt relief from Hollywood Florida. Quick and Easy Application.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Trusted by Over 1000000 Customers. Have at least 5000 in outstanding student loan debt upon applying for the tax credit.

Ad Get a Personal Plan to Fit Your Budget. About the Company Maryland Student Loan Debt Relief Tax Credit 2021. You Decide How When You Want to Pay.

Complete the Student Loan Debt. About the Company 2021 Maryland Student Loan Debt Relief Tax Credit Program. Maryland student loan tax credit 2021.

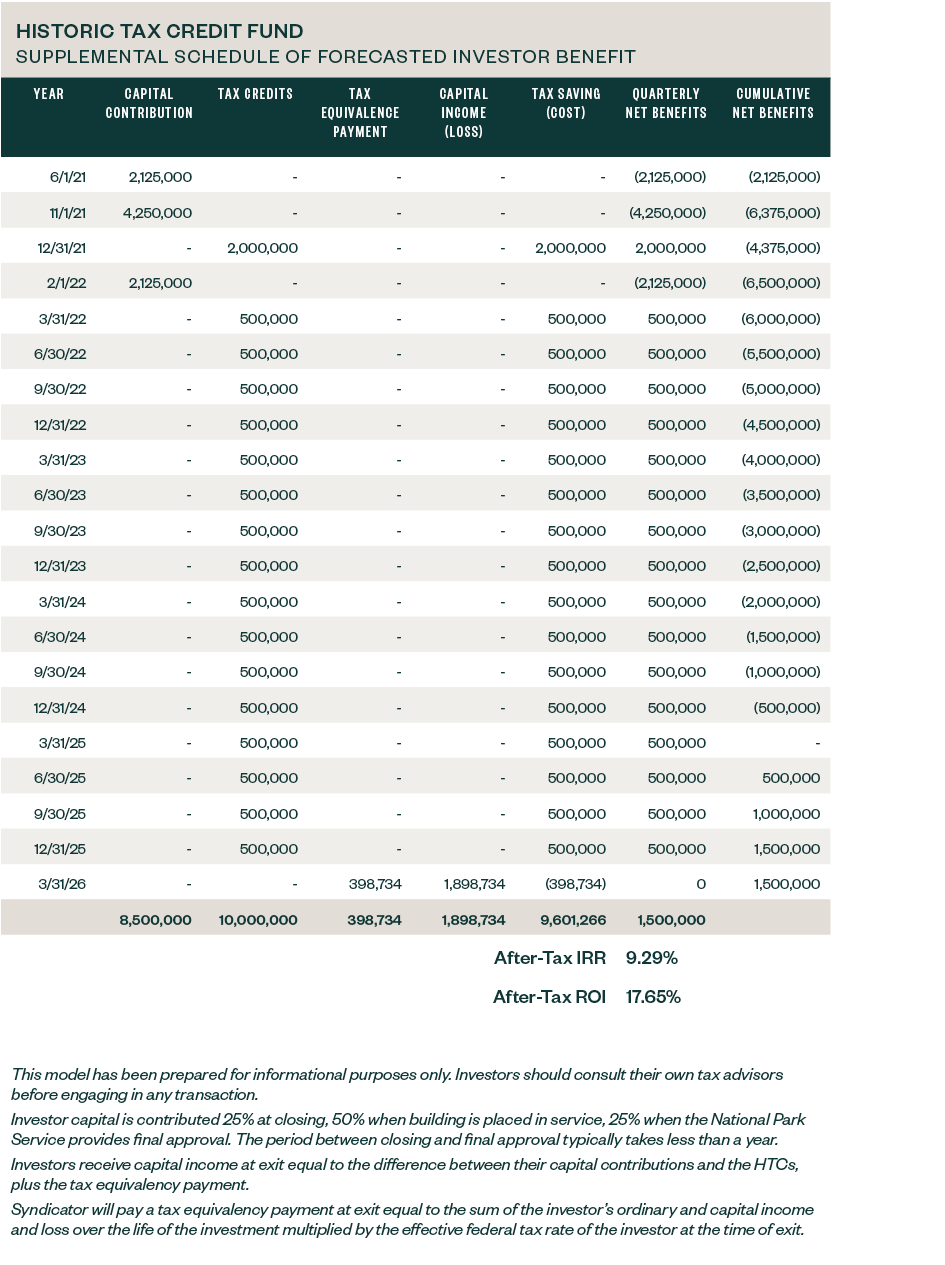

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the. About the Company Maryland Student Loan Tax Relief Credit. An official website of the State of Maryland.

About the Company Maryland Student Loan Debt Relief Tax Credit Application. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application. Quick and Easy Application.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. CuraDebt is a company that provides debt relief from Hollywood Florida. Easy Application Process Multi-Year Approval No Payments until Graduation.

Payment voucher with instructions and worksheet for. Detailed EITC guidance for Tax Year 2021. Claim Maryland residency for the 2021 tax year.

It was established in 2000 and. Ad Expert Reviews Analysis. April 16 2021 by Leave a Comment.

Easy Application Process Multi-Year Approval No Payments until Graduation. Trusted by Over 1000000 Customers. It was established in 2000 and is a member.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Ad Expert Reviews Analysis. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. Personal Tax Payment Voucher for Form 502505 Estimated Tax and Extensions.

Form to be used when claiming dependents. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

What Is A Homestead Exemption And How Does It Work Lendingtree

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Education Or Student Tax Credits To Claim On Your Tax Return

How To Acquire Federal Tax Credit Investments

Here S The Average Irs Tax Refund Amount By State

Learn More About A Tax Deduction Vs Tax Credit H R Block

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Child Tax Credit Update How To Change Your Bank Info Online Money

Stove Cost Savings Tax Credit Hpba

Parents Guide To The Child Tax Credit Nextadvisor With Time

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Child Tax Credit Schedule 8812 H R Block

/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)